Quick Answer

Are personal injury settlements taxable?

Not usually. Personal injury settlements are typically tax-exempt. However, some parts of a settlements, such as punitive damages, can be subject to a personal injury settlement tax.

Going through a personal injury settlement can be an overwhelming and lengthy process. And if you received any sort of financial compensation, you may be facing another long road ahead: personal injury settlement taxes.

First things first: Do you pay taxes on a personal injury settlement, and how much do you pay on settlement money? If you're in the final stages of a settlement, you might be wondering how much you'll be able to take home after taxes — or if you have to pay taxes at all. The answer is usually no, but it’s not entirely black or white. The type of settlement you receive will dictate whether it is taxable or not.

To ease up the process, we’re overviewing almost everything you need to know about the taxability of personal injury settlements, including which ones are taxable and whether it is possible or how to avoid paying taxes on settlement money for personal injury.

Do You Pay Taxes on a Personal Injury Settlement?

"Is a personal injury settlement taxable?" Personal injury settlements are one of the few settlements that are tax-exempt, but there are some exceptions.

Before we go into the exceptions, let’s delve into why personal injury settlements wouldn’t be taxable. It's because this type of financial compensation helps you recover or get reimbursed from a loss, such as physical injuries, medical bills, or property loss. This means that it's not a form of income or fruit of your labor — instead, it's considered a liability, which is not taxed.

However, there are some factors that the IRS will take into consideration when determining whether your settlement is taxable or not. If your personal injury settlement is allowed to be excluded from your gross income, both the lump sum settlement and any future periodic settlement payments are non-taxable.

Personal injury settlements are nontaxable in cases involving “observable bodily harm,” as per 26 U.S. Code § 1041, especially in the following cases:

- Motor vehicle accident settlement

- Slip and fall settlement

- Medical malpractice settlement.

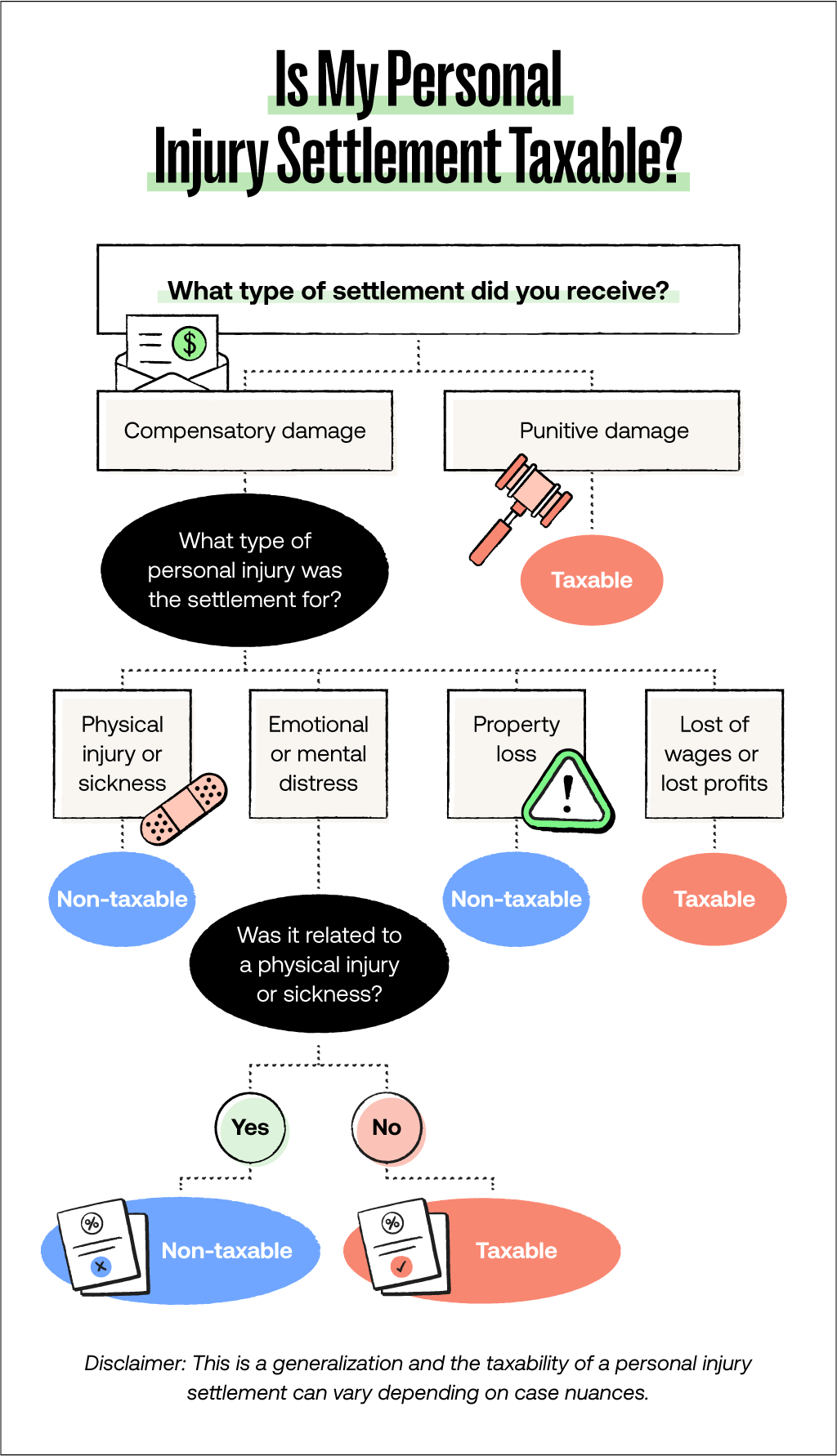

As a general rule, a personal injury settlement will be:

- Taxable: to the extent you received compensation for lost wages connected to a personal injury

- Likely taxable: to the extent you received compensation to punish a defendant, also known as punitive damages

- Not taxable: if your settlement was for pain and suffering, to reimburse you for medical bills, or for other emotional and mental distress related to an injury or sickness

And just because part of your settlement is taxable, doesn’t mean the other part isn’t. So if your award is for 80% pain and suffering and 20% punitive damages, you would only pay taxes on the 20% that is taxable.

Because it can be difficult to determine whether and to what extent your personal injury settlement is taxable, we'll break down each type to help you figure it out.

Types of Non-taxable Personal Injury Settlements

Your personal injury settlement compensation will be non-taxable in many cases because the compensation amount you earned was not related to your income or product of your labor.

Here are the types of personal injury settlements that you won't have to report on your taxes.

Physical Injuries or Sickness

If you received a settlement for a personal injury or sickness and you didn't take an itemized deduction for medical expenses related to it, you will not be taxed.

However, if you claimed a medical expense2 deduction in any prior years, you will have to report that on your taxes. You will also have to pay taxes on a portion of your car accident settlement on a pro rata basis if you took the deduction for more than one year.

Emotional and Mental Distress

If your settlement for emotional and mental distress originated from a personal injury or sickness, you will not be taxed. This type of settlement will be treated the same as a physical injury settlement for tax purposes.

This means you'll also have to report any claimed medical expense deductions and pay taxes on a pro rata basis if you took the deduction for more than one year. If the emotional distress or mental anguish didn't stem from a personal injury, however, you will have to report it as part of your income.

Property Loss

If your settlement included awards for property damage, most of the time it won't be taxed. This could be the case if you receive compensation to have your vehicle repaired after a car accident.

However, these types of settlements are only non-taxable if the compensation was less than the cost of acquiring that property. If the compensation is higher, then you'll have to pay taxes on the excess amount, since this excess would be considered income.

Wrongful Death

If you filed a wrongful death lawsuit on behalf of a family member and received a settlement for it, compensation damages will not be taxed.

Car Accident Injury Settlements are Almost Always Nontaxable

In most car accident and personal injury settlements, the compensation received is generally not taxable. This includes settlements for injuries, pain, and suffering. Importantly, attorney contingency fees in these types of cases are also not subject to taxation. However, if a settlement includes reimbursement for medical expenses that were previously deducted in a prior tax year, that portion may be taxable. Otherwise, personal injury settlement amounts should not be included as income on your tax forms.

Types of Taxable Personal Injury Settlements

In some cases, your personal injury settlement will be taxed. That's because the amount received is not tied to a loss, so it counts as a personal gain and should be taxed.

Here are the types of taxable personal injury settlements.

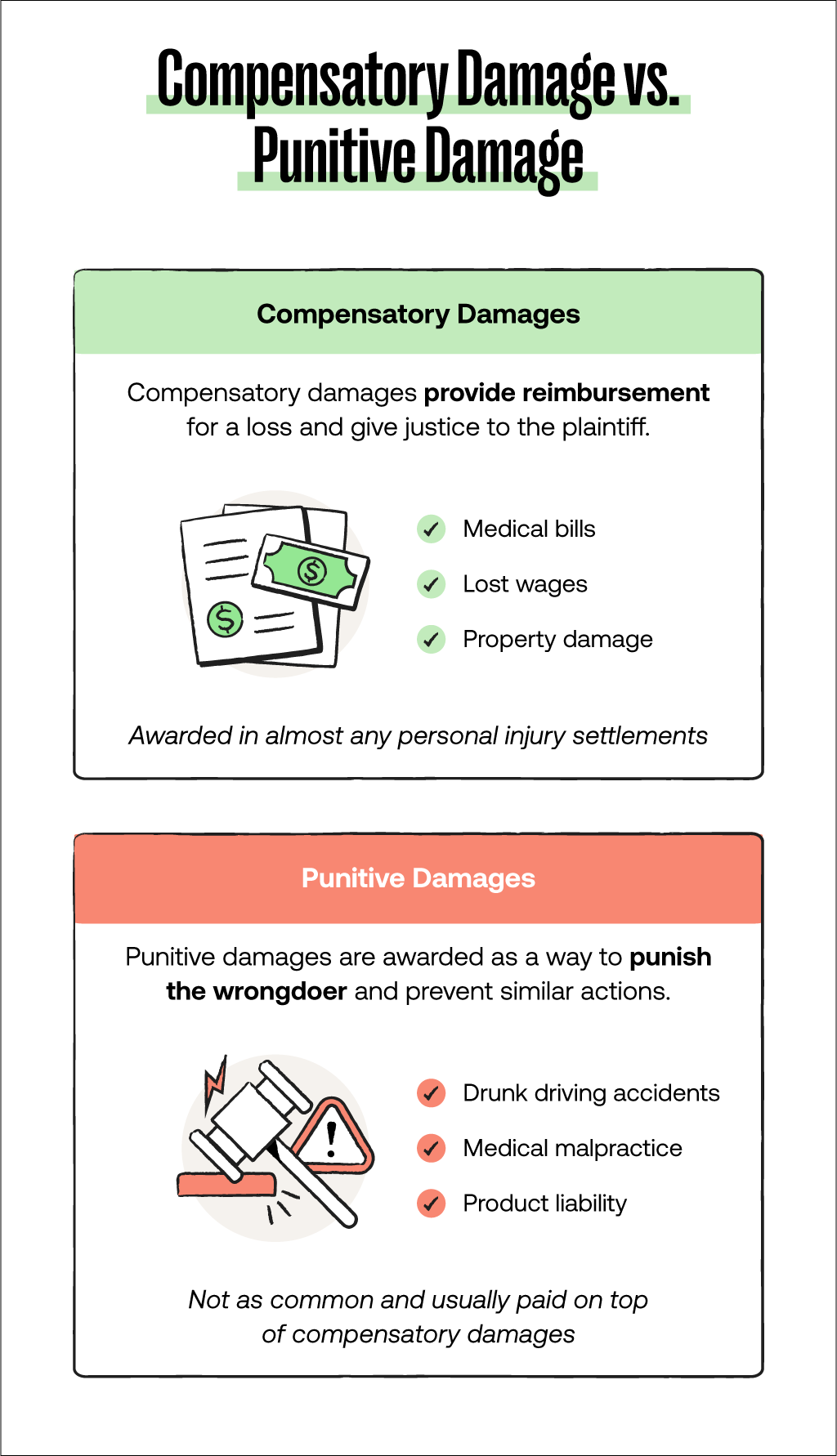

Punitive Damages

If you receive any sort of punitive damage in a settlement, they will be taxed, even if tied to a physical injury settlement. That's because punitive damages are awarded to you in order to punish the defendant.

Punitive damages are different from compensatory damages since compensatory damages are awarded to you to compensate for your loss, like injuries and medical bills.

On the other hand, punitive damages are not meant to compensate for your loss, but instead punish the wrongdoer. For this reason, these damages are considered a gain and are therefore taxable.

Lost Wages

Depending on your personal injury settlement, you will receive compensation for lost income. These settlements are awarded to compensate for the time you missed at work due to an injury.

Since this type of settlement is compensating for lost income during that time period, it is directly related to your income, so this portion of your settlement will be taxed.

Lost Profits

Similar to lost wages settlements, you might receive compensation for lost profits from your business or trade. This type of compensation is awarded to help you continue working on your business or trade.

Because this settlement is considered net earning, it will be taxable and subject to self-employment tax.

Emotional Distress Cases

It's common to feel emotional distress when working on a settlement, especially if you’re working with a billboard lawyer. In some cases, you might also be awarded compensation for mental anguish.

Since this compensation did not arise from a personal injury or illness, your settlement will be taxable. However, you can still reduce from this amount any medical expenses not deducted from your taxes, and medical expenses deducted for mental distress that did not provide a tax benefit.

How Does the IRS Collect Settlement Taxes?

The IRS (Internal Revenue Service) will collect taxes on a personal injury settlement when it comes time for you to file your tax return for the previous year. In these cases, working with a personal injury attorney will be helpful to ensure that you complete the form appropriately.

If your settlement is taxable, you will generally have to include it as part of your income in Form 1040. Although the taxability of personal injury settlements will vary by type, you can, for the most part, follow these rules when filling your taxes:

- Punitive damages, lost wages, lost profits and other taxable awards: Report them as income.

- Compensatory awards for physical injuries, emotional distress and property loss: Do not report them as income.

- Interest earned on your settlements: Report it as income.

Since a taxable settlement is considered income, the amount the Internal Service Revenue or IRS will tax you will vary depending on the amount you were awarded and the taxable income bracket you're in.

If your settlement is taxable and you're working with a law firm, they are required to issue you a 1099-MISC form with your settlement reported as part of "other income."

Keep in mind that if you're working with a lawyer on a taxable personal injury settlement, the attorney fees will also be considered part of the award. This means you will also be taxed for the portion of the settlement that goes to your personal injury lawyer.

How To Reduce Taxes on a Personal Injury Settlement

You want to ensure that you're reporting the correct amount for your settlement when filing your taxes. And while there is no surefire way to know how to avoid paying taxes on settlement money altogether, one of the best ways to reduce personal injury settlement tax is by hiring a great personal injury lawyer.

A personal injury lawyer will help you understand what type of compensation was awarded during your settlement and assist with calculating the amount that should be included in your income.

What's more, a lawyer can help you structure your settlement to avoid being wrongfully taxed. They will do so by splitting your payments, rearranging amounts and ensuring that you get the settlement you deserve. Working through a settlement can be difficult, especially when it comes time to file your taxes. That’s why it's important to work with a lawyer to understand the taxability of personal injury settlement and ensure you’re compensated fairly.

FAQs About the Taxability of Personal Injury Settlements

Understanding whether your settlement is taxable can raise a lot of questions. Here are some questions you might be asking yourself.

Are Settlement Proceeds Taxable?

Generally, no personal injury settlements are not taxable, although it may vary by the type of settlement. Most personal injury settlements aren't taxable if you were awarded compensatory damages. If you were awarded punitive damages, then your settlement proceeds are taxable.

Do I Have To Report Settlement Money to the IRS

If you don’t have a personal injury lawyer, you may have to figure out if any of your settlement is taxable and report settlement money to the IRS under income if your compensation was considered taxable. If you have a personal injury lawyer, they will typically do that for you.

What Percentage of a Settlement Is Taxed?

Only the percentage that’s attributable to punitive damages, lost wages, or other taxable compensation. Don’t worry, if a small part of your settlement is taxable, it doesn’t make the rest taxable too if it otherwise qualifies as tax-free.

How Do I Report Settlement Income on My Taxes?

The best way to report settlement income on your taxes is by working with a lawyer because they should send you a tax form at the end of the year if your settlement is taxable. The settlement will generally be included as part of "other income" on your tax return form.

Sources

- United States Code - https://uscode.house.gov/view.xhtml?req=granuleid:USC-prelim-title26-section104&num=0&edition=prelim

- IRS.gov - https://www.irs.gov/pub/irs-pdf/p4345.pdf

Know Your Claim’s Worth—and Settle It

Serious injury or no injury at all, move your case forward instantly from your phone.

Thank you for submitting your information.

About the author

Joshua is a lawyer and tech entrepreneur who speaks and writes frequently on the civil justice system. Previously, Joshua founded Betterfly, a VC-backed marketplace that reimagined how consumers find local services by connecting them to individuals rather than companies. Betterfly was acquired by Takelessons in 2014. Joshua holds a JD from Emory University, and a BA in Economics and MA in Accounting from the University of Michigan.